Accounting Reconciliation in NetSuite

What is NetSuite Accounting Reconciliation or NSAR?

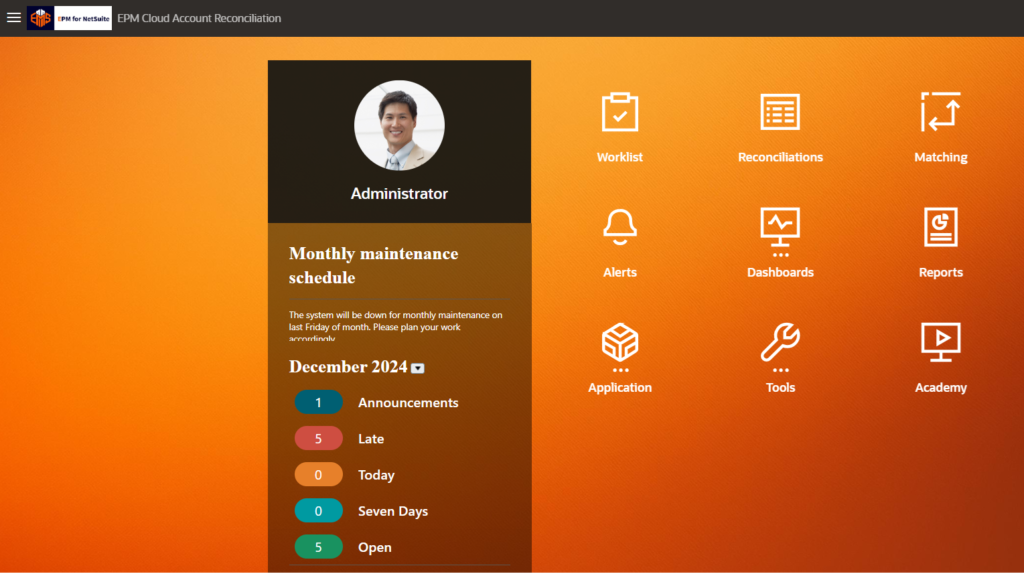

NetSuite Accounting Reconciliation (NSAR) is a key component of the NetSuite Performance Management (EPM) suite, introduced to streamline and automate essential financial processes. According to its official datasheet, NSAR “automates general ledger account reconciliations, including bank reconciliations, credit card matching, intercompany transactions, accounts receivables and payables, and invoice-to-PO matching, all in one centralized workspace.” Additionally, it features a powerful transaction matching engine to enhance efficiency.

Challenges in the Traditional Reconciliation Process

Reconciliation is one of the most time-consuming tasks during a company’s financial close process, especially for organizations subject to regulatory and non-regulatory compliance requirements. Traditional methods are often prone to manual errors, such as human mistakes or inconsistent data, leading to significant rework.

For example, one of our customers reported that more than 30 accounting team members were assigned solely to perform manual reconciliation each month. This highlights the inefficiency of traditional methods and underscores the value of an automated solution like NetSuite Accounts Reconciliation.

Key Features of NetSuite Accounts Reconciliation (NSAR)

The NSAR module goes beyond solving basic account reconciliation challenges. It delivers:

Scalability: Built on Oracle Cloud Infrastructure for enhanced scalability and security.

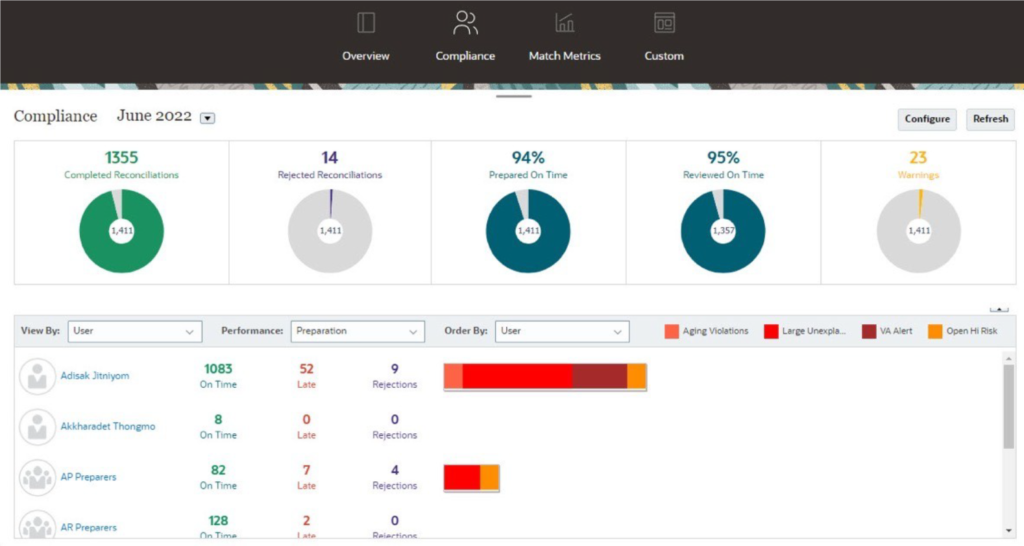

Compliance and Control: Ensures adherence to regulations and internal policies.

Configurable Workflows: Tailor workflows to meet specific business requirements.

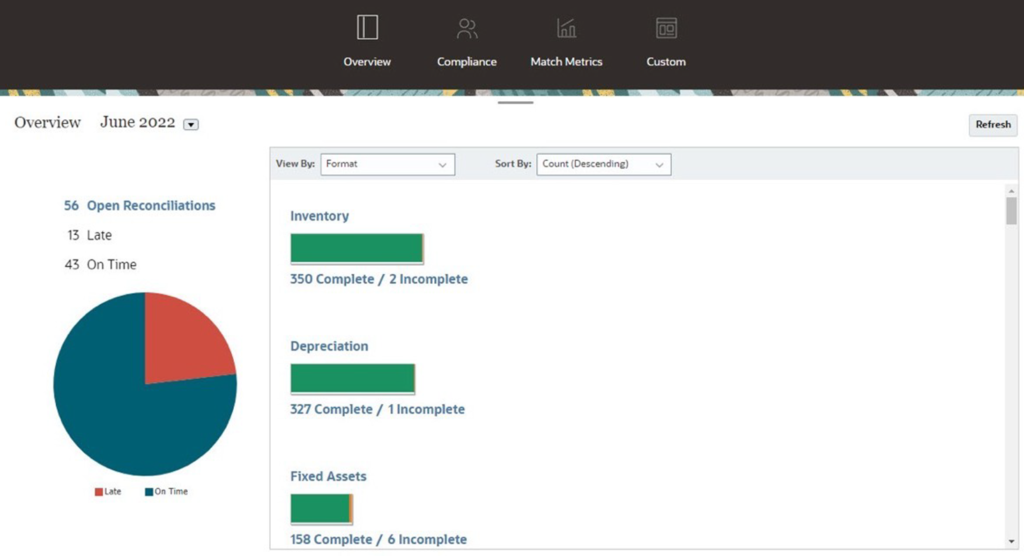

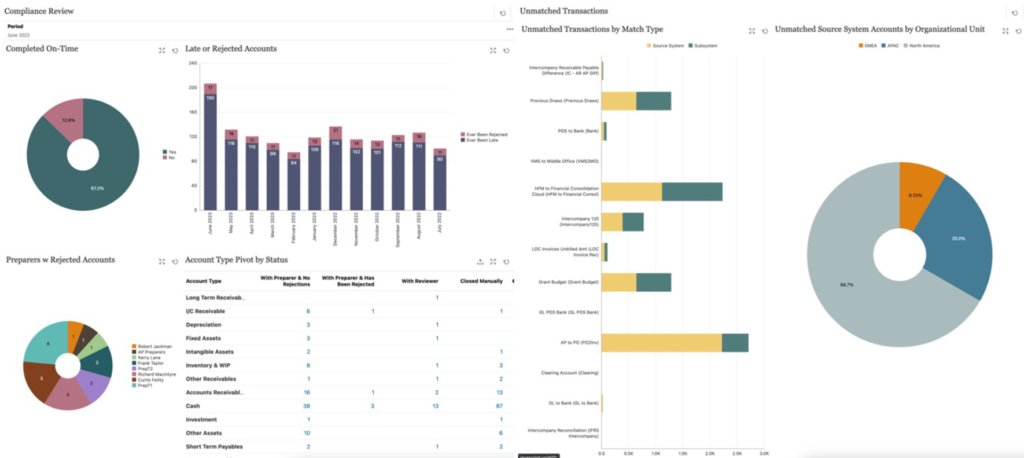

Real-Time Visibility: Gain instant insights into reconciliation statuses and issues.

Seamless Integration: Integrates with other systems and collaboration tools to improve efficiency.

Main Functions in the Accounts Reconciliation Process

The reconciliation process in NSAR is structured around the following key functions:

Administrator Functions

• Data Import

• Application Configuration

• Format Updates

Reconciliation Creation

• Profile Updates

• Workflow Changes

• Create Reconciliations for the Period

Reconciliation Performed

• Review the Balances

• Add Explanations and Adjustments

• Provide Documentation

• Variance Analysis

Approval

• Review of Reconciliations

Reporting and Review

• Report Generation

• Continuous Monitoring

Audit and Compliance

• Review Audit Reports

• Compliance Checks

• Create Report Binders

Benefits of Implementing NetSuite Accounts Reconciliation

Implementing NSAR provides companies with a centralized, automated, and secure way to handle reconciliations, saving time and reducing errors. This automation allows finance teams to focus on higher-value tasks, such as financial analysis and strategic planning.

How Much Does NetSuite Accounts Reconciliation Cost?

While it’s difficult to define exact pricing for NSAR implementation, the total cost typically includes both licensing fees and service costs. Here’s a general breakdown:

- Initial Investment: At least €50K for the first year, which includes a minimum of 4 months for implementation.

- Ongoing Annual Costs: At least €15K per year for maintenance and updates.

Although these costs may seem significant, they are often outweighed by the savings in man-hours and reduced rework compared to manual reconciliation processes.

Why Choose NetSuite Accounts Reconciliation?

If your company struggles with manual reconciliation, the NetSuite Accounts Reconciliation module can transform your financial close process. By automating time-intensive tasks and providing real-time insights, NSAR helps finance teams stay compliant, accurate, and efficient.

Learn more.

Visit our YouTube channel.

Follow us at LinkedIn

Subscribe to our NetSuite EPM Newsletter

Comment at the LinkedIn article “Accounts Reconciliation“.