The Importance of Financial Planning & Analysis (FP&A) for Midsize Companies

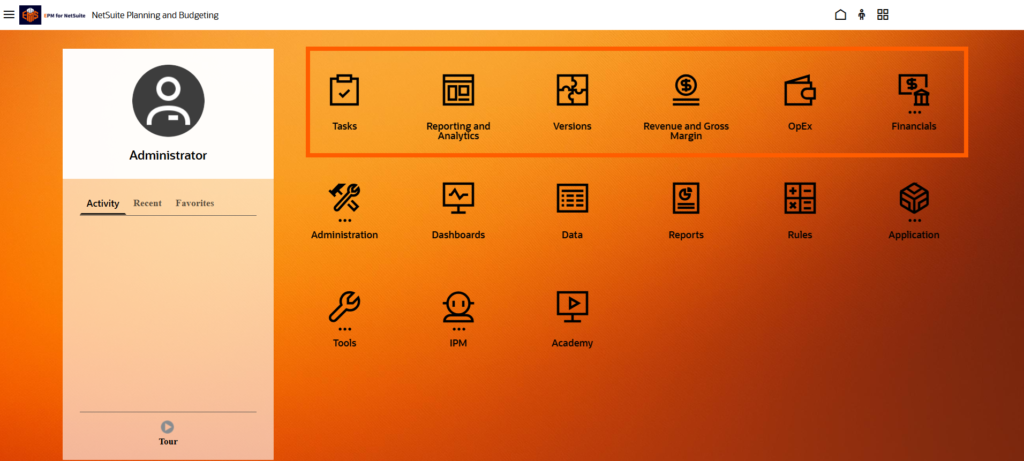

Financial Planning & Analysis (FP&A) is a critical component for the success of midsize companies and Netsuite Planning & Budgeting (NSPB) Financials offers the best price/performance platform to implement it if you are already a NetSuite ERP user.

In an increasingly competitive market, these organizations must leverage every tool available to maintain and grow their financial health. Implementing robust FP&A processes offers several benefits, particularly in improving cash flow management, which is vital for operational stability and growth.

Key Benefits of FP&A for Midsize Companies

1. Improved Cash Flow Management

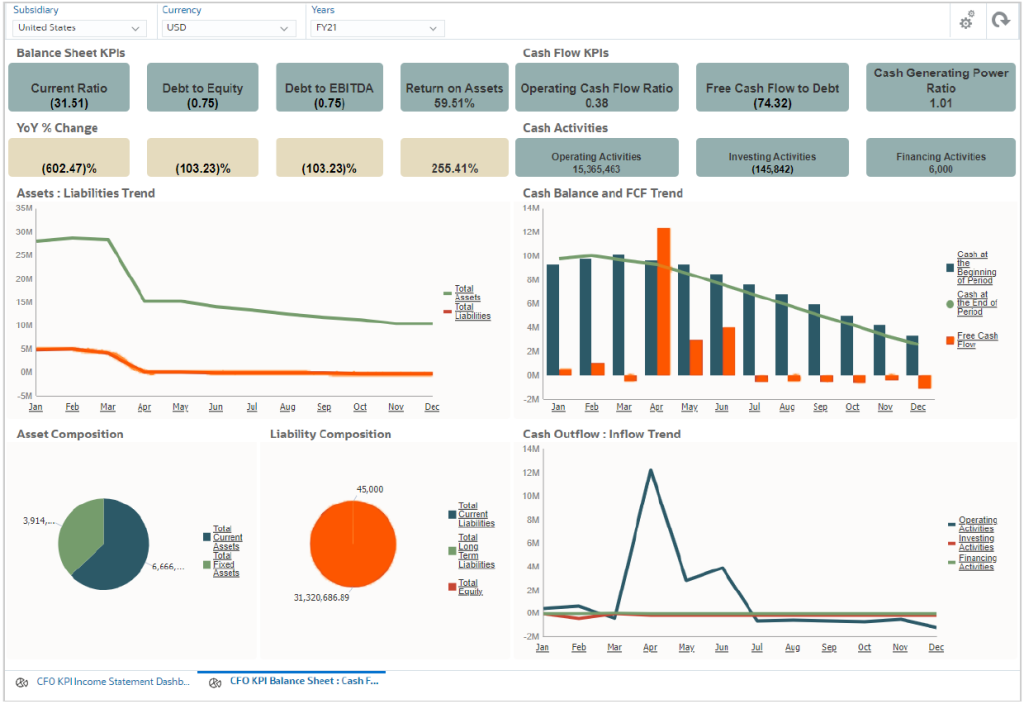

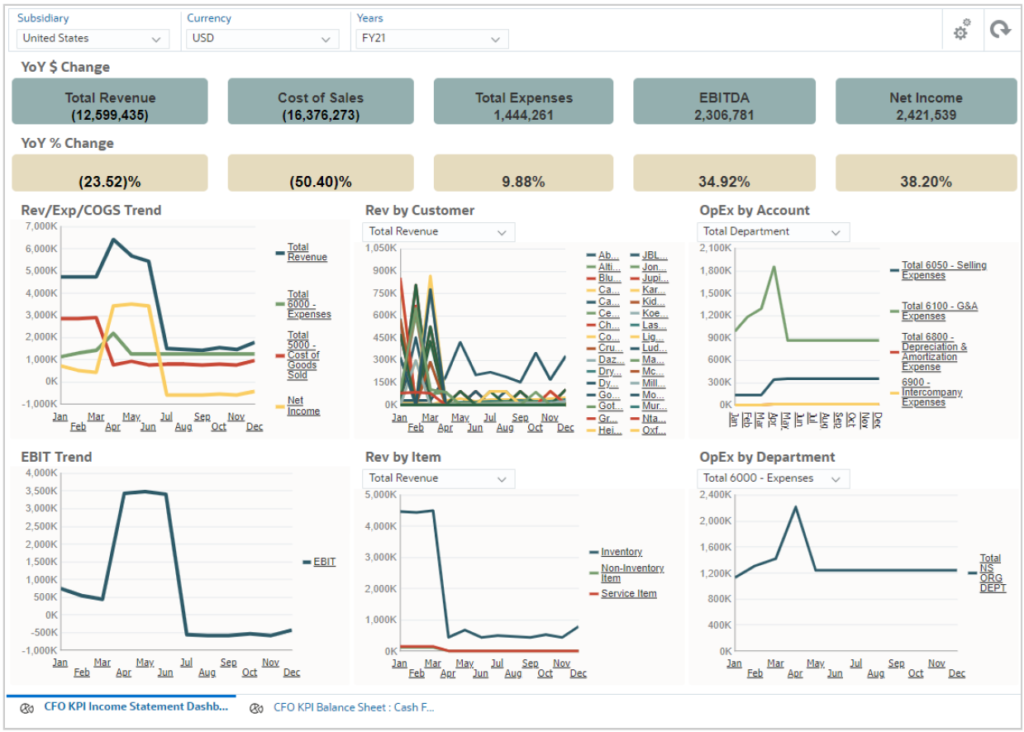

Effective cash flow management ensures that a company has enough liquidity to meet its obligations and invest in growth opportunities. FP&A plays a pivotal role by providing accurate cash flow forecasts, identifying potential cash shortages, and optimizing working capital. By analyzing cash inflows and outflows, FP&A helps midsize companies make informed decisions about expenditures, investments, and financing needs.

2. Enhanced Decision-Making

FP&A equips management with detailed financial insights and predictive analytics. This enables more informed decision-making, allowing companies to navigate economic fluctuations and market changes with greater agility. With comprehensive financial reports and models, midsize companies can evaluate the impact of various scenarios on their cash flow and overall financial health.

3. Strategic Planning and Growth

FP&A is integral to strategic planning. It helps midsize companies set realistic goals, develop budgets, and allocate resources efficiently. By aligning financial planning with business strategy, companies can identify growth opportunities and invest in initiatives that yield the highest returns. This strategic alignment is crucial for sustainable growth and long-term success.

4. Risk Management

Midsize companies face numerous financial risks, including market volatility, economic downturns, and operational disruptions. FP&A helps mitigate these risks by providing early warning signals through financial analysis and scenario planning. This proactive approach enables companies to take corrective actions before potential issues escalate, thereby protecting cash flow and financial stability.

Conclusion

For midsize companies, FP&A is not just a financial function but a strategic asset. It enhances cash flow management, supports informed decision-making, facilitates strategic planning, and mitigates financial risks. By leveraging FP&A, midsize companies can achieve greater financial resilience, operational efficiency, and sustainable growth.

Want to learn more ?

Subscribe to our Blog and download the IMA’s Key Principles of Effective Planning and Analysis (LinkedIn)

See Gary Cokins explaining why having more than 25 employees requires you to have a FP&A process.

Want to Comment ?

Do it at our LinkedIn article “The Importance of FP&A for Midsize Companies”

Ask an anonymous question in our Reddit channel.